Disclaimer

The information provided is assumed to be true but is provided for informational purposes only. Because each property and each buyer or seller is different, please seek the advice of a professional real estate broker or an attorney when making real estate or other investment decisions.

Single-family home prices in Polk County Fl. at the end of 2020, averaged $132. per sqft.

December 2006, 14 years ago when home prices in Polk County had reached their peak (at the end of a very sharp rise in prices), prices averaged $125 per sqft. At that time, the supply of single-family homes for sale was nearly 7,500 and climbing, that same month there was 409 pending and 570 sold.

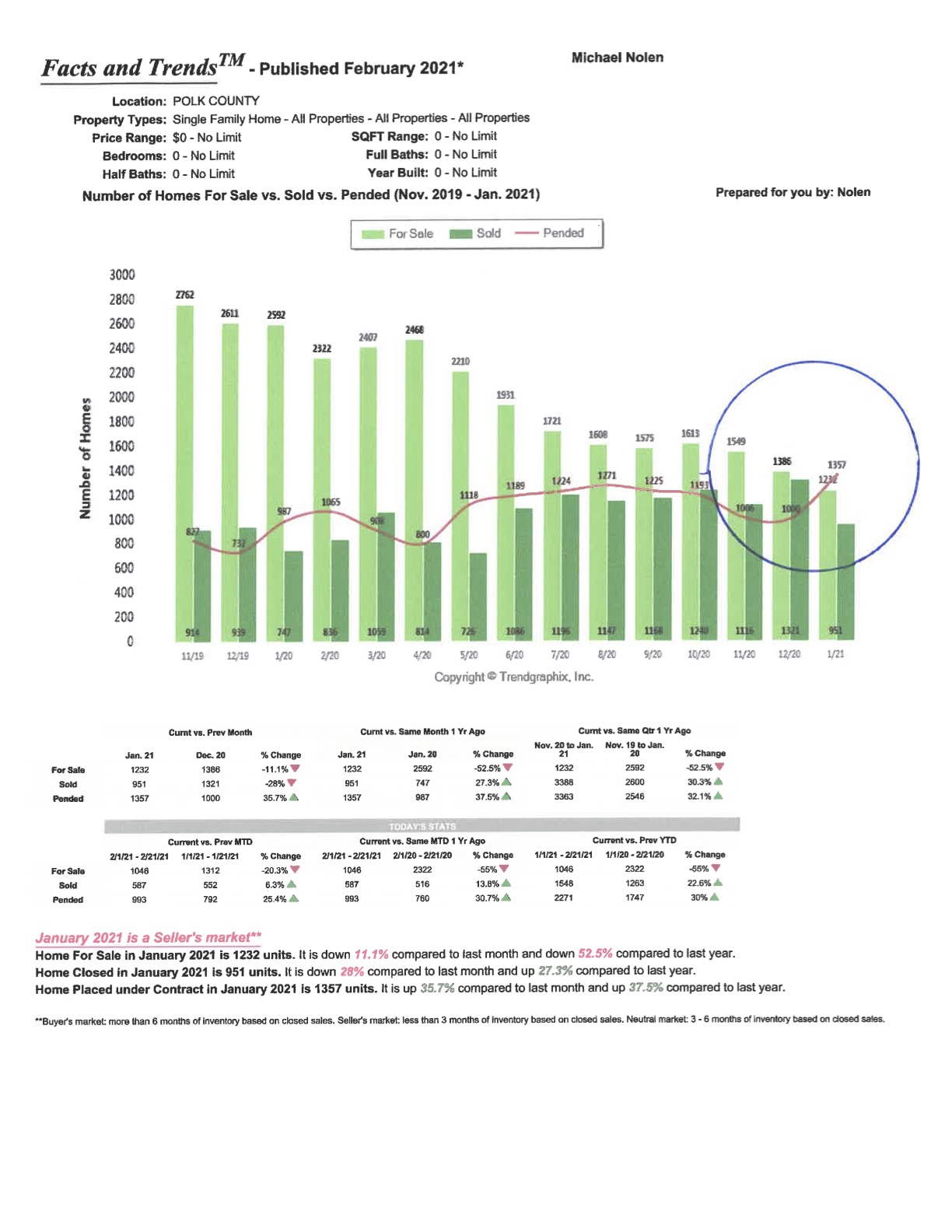

Today, February 2021 the supply is only 1,386 and trending down. There are 1,357 contracts pending and 1,511 homes sold in Polk County for the month of February 2021. Think about that … over 2 ½ times the number selling and a supply that is only about 1/4th of what it was in December 2006. More importantly though, the trend is down, fewer homes coming on the market.

That means we could be in for much higher prices for single-family homes. Back in mid-summer 2005, after bottoming out, the supply of homes for sale started increasing. Virtually every month the supply of homes for sale increased, and still, the prices of homes kept increasing. It was nearly 18 months of increasing supply before prices started falling. Once they started falling the bottom dropped out and the great recession began. By December 2008 prices were under $100.00 per sqft and still declining.

So, what does all this mean? What’s the same as before and what’s different?

Well, for one, the requirements for qualifying for a mortgage have gotten more stringent. So, I think the financial sector is stronger than before the great recession.

People were coming to Florida then, and they still are coming to Florida. So that is the same. Though perhaps the rate of increase might be a little more now. People are leaving northern urban centers where commerce has been severely limited, for more open states like Florida. And cold weather like they’re having now, will probably add to this push for the freer commerce states of the south.

Then, interest rates were low, and today interest rates are even lower.

Back in ’05 and ’06 land was expensive, and governments significantly increased the cost of building by adding more regulations and in some cases, seriously high impact fees. Today, land is still pricey, regulations and impact fees are not quite as bad, but the price of materials have drastically increased. So, new construction prices are increasing, which in turn allows resale prices to escalate.

So, perhaps COVID-19 will slow prices down? Maybe employment will be the problem that holds us back? Perhaps, but our employment numbers look fairly good when you compare it to New Jersey, Connecticut, New York, Rhode Island, etc. And I’m guessing, our future will be even brighter (at least short term) as additional stimulus comes our way. Of course, what the above states and many others have over us, is their higher wages. Average incomes in New Jersey is over $85,000.00, Connecticut nearly $79,000.00, New York over $68,000.00 and Rhode Island over $67,000.00. All the while Florida’s average wage earner makes just over $55,000.00 a year. Thus, if anything will hold prices in check, Florida’s lower average incomes might be the factor that holds property values in check.

So, look for higher real estate prices, but perhaps prices that will still be anchored to reality.

1,242 total views, 2 views today